Car Loan Approval Malaysia

Use our car loan calculator to find finance that matches your budget. Most banks have a net interest margin of between 2 - 3.

Toyota Capital Conventional Hire Purchase Toyota Capital Malaysia For Your Auto Financing Needs

RM4000 RM7000 5714.

. Up to 9 years tenure Up to 90 margin of finance DISCOVER APPLY NOW My First Car Plan. Duration of Loan approval Once the verification process is completed the loan officer might call your employer to determine that you are providing accurate information and that you have a sound income. To make sure you receive the news as soon as possible our staff will contact you once the loan is approved.

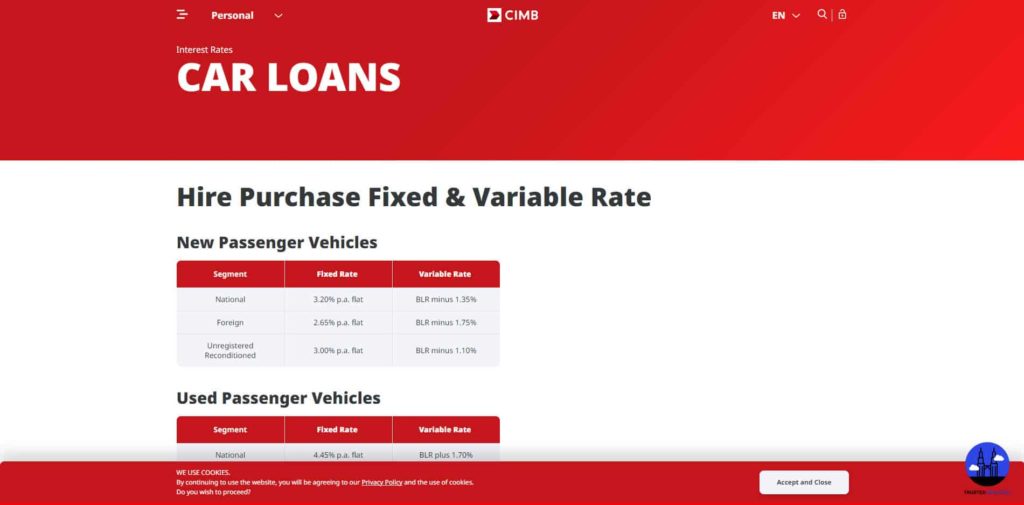

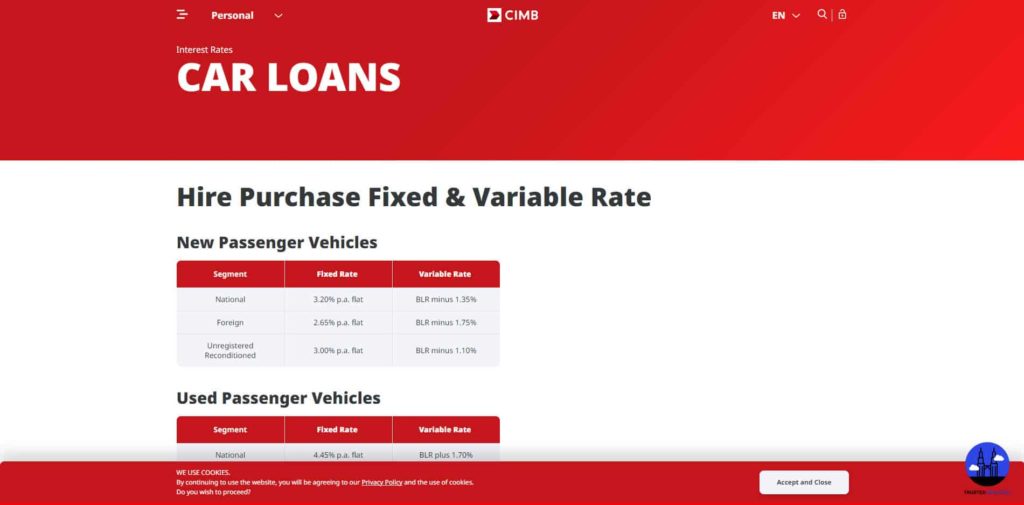

However you will find many banks do not disclose the general range of interest rates as this varies depending on deals they have with particular car manufacturers. Banks are usually willing to offer a margin of financing up to 90 in both cases. Name Phone Number IC number and Income Statement.

Malaysia car loan calculator to calculate monthly loan repayments. Hong Leong Bank Car Financing You Pay RM 598 mth Interest Rate 324 pa. Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan.

Public Bank Vehicle Financing You Pay RM 601 mth Interest Rate 331 pa. Below is a summarised diagram of a typical car loan application process in Malaysia. The process of getting an approval for a car loan typically takes one to two days.

For Car Financing Ambank Hire Purchase is the no1 Car Financier in Malaysia with fast loan approval. Then you will be informed in about 3. All loan amounts shown are indicative according to criteria provided by banks and do not constitute a guarantee of bank approval or loan amount obtainable.

It consist of 3000 appointed car dealers with complete auto solutions. Car prices are expected to increase and be higher than the GST price by approximately 2 to 3. Weve got flexi loans graduate loans low interest rate loans and the best used car loans on the market.

Currently has 3 loans. Since BNM has cut the OPR by 125 I had expected the lending rates to be a bit lower than what is shown. A car loan requires documentation regarding the car as it is the guarantee that is used as the basis for the loan.

Understand your Personal Financial Performance. Maybank Car Loan You Pay RM 605 mth Interest Rate 340 pa. Second and subsequent vehicle loans to the officer is allowed after five 5 years from the date of approval provided that the existing loan has been fully settled.

Depending on the amount you are borrowing and the loan tenure. Why we love it. Loans enable you to hold on to your cash in hand by charging you an interest over a.

1-hour fast approval loan process. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia. Generate car loan estimates tables and charts and save as PDF file.

To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application. You are eligible for an amount of up to RM 0 With a monthly payment of RM 0 You can afford a monthly payment of up to RM 0. An approval of loan amount can be performed within a short period of time of two.

DISCOVER TALK TO US Hire Purchase Financing for your new secondhand and reconditioned motor vehicles Benefits. His debt service ratio would be calculated as. The banks valuation of the car is important since it serves as a collateral in case of loan default.

In Malaysia car loan tenures can take up to 5 7 or even 9 years. Compare Car Loans in Malaysia 2022. Although you should probably be prepared with around 30 of the total amount.

If youve been planning to buy a car and apply for a car loan in Malaysia youll be well-advised to make the purchase before the Sales and Services Tax SST comes into force on September 1. The Hong Leong Mach IOU Personal Loan offers an interest rate of 7 pa. Your credit history the speed at which you can provide adequate documentation verifying your identity and your.

By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time. You can get the Financial Assessment Check by just providing us with your personal details. We found 9 car loan s for you.

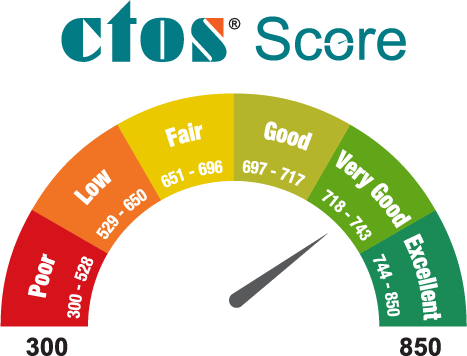

The Financial Assessment Check will provide you with a full image of your Personal Financial and the possibility of getting your car loan approval. Maybe local cars 25 and foreign cars 225. You can apply for and get home loans car loans from most banks.

20 cashback on timely payments terms and conditions apply Loanable amount. A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car. It consist of 3000 appointed car dealers with complete auto solutions.

The advertised rates range from 23 pa to 425 pa. If its RM65000 - an approved loan is RM59900. You can get personal loans from the loan sharks but unless youre super extremely desperate please dont.

With an income of RM7000 monthly and a monthly commitment of RM4000 Matthew has a debt ratio of 5714. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month. Best Car Loans in Malaysia Whether youre buying a new or used car youll find our comprehensive Malaysian auto loan list steers you in the right direction.

Finding out if your car loan has been approved can be quite exciting and we understand that this is something you just cant wait for. All loans are still subject to final approval from banks. Shopping for a car loan for your new or used car.

My own car loan in Sept was for a Proton and it was at 313. Personal Loan RM1000 Housing Loan RM2500 and Car Loan RM500 Total monthly commitment. All outstanding financing amount for your car will be paid in the event of Death or Total and Permanent Disability during financing tenure.

Recommended RHB Bank Auto Financing You Pay RM 595 mth Interest Rate 318 pa. Depending on bank and car typemanufacturer. If its RM55000 an approved loan is RM55000.

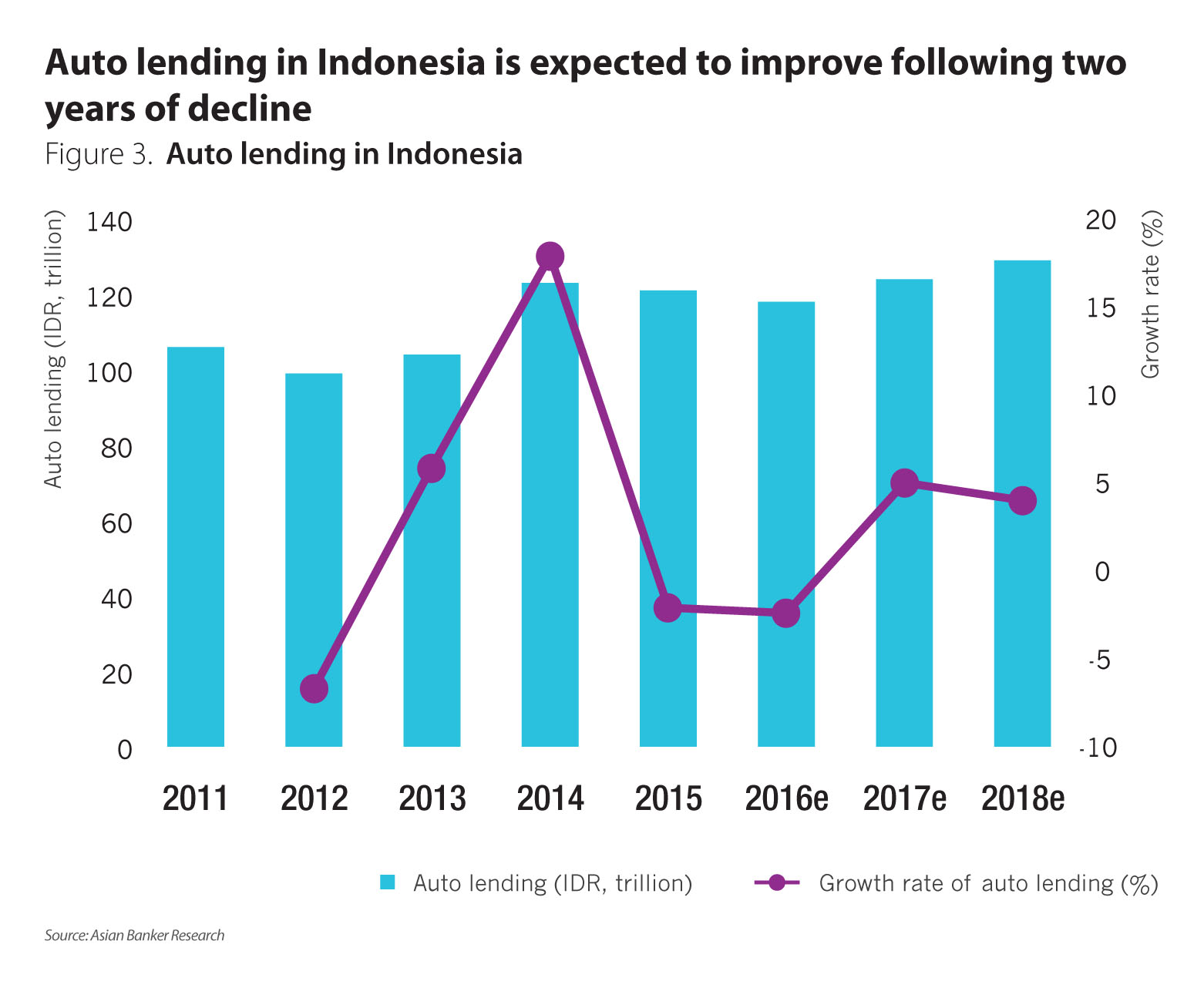

Huge Potential For Auto Lending In Southeast Asian Emerging Markets The Asian Banker

A Guide To Car Loans Interest Rates In Malaysia

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

A Guide To Car Loans Interest Rates In Malaysia

5 Banks That Offer The Best Car Loan In Malaysia 2022

Tougher Approvals Seen For Car Loans

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

9 Things To Look Out For When Applying For A Car Loan

Car Loan In Malaysia The Basics Carloan Com My

A Beginner S Guide To Car Loans Infographic Carsome Malaysia

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

5 Banks That Offer The Best Car Loan In Malaysia 2022

The Malaysia Type Of Car Loan Proton April 2022 Tax Holiday Rebate Rm7000 Interest Rate As Low As 2 8

Should You Pay Back Your Car Loan Early

5 Banks That Offer The Best Car Loan In Malaysia 2022

Comments

Post a Comment